SBA 7(a) loans are the most commonly used loan option for business financing. These loans can be used for a wide range of purposes, including business acquisitions, start-ups, working capital, business expansions, debt refinance, equipment and supplies.

Loan terms are dependent upon purpose; for example, while many 7(a) loans are 10 years, the maximum term for real estate loans is 25 years.

Loan Requirements

General SBA 7(a) loan requirements state that your business must:

- Be a for-profit business operating in the U.S.

- Be a small business, as defined by the SBA

- Have, as a business owner, invested your own time and money into your business

Interest Rates

Rates are based on the Wall Street Journal prime rate plus a lender spread, which is subject to SBA maximums, based on the term length, or maturity, and the loan size.

Loan Type Options

While SBA 7(a) is used as a general term, there are many loan types within the program. The best type of loan for your business will depend on how you will use it and when you will need it.

Business owners seeking to buy commercial real estate, equipment, machinery or other major fixed assets can consider SBA 504 loans as an option.

Business owners looking for debt refinance may benefit from the SBA 504 Debt Refinancing Program.

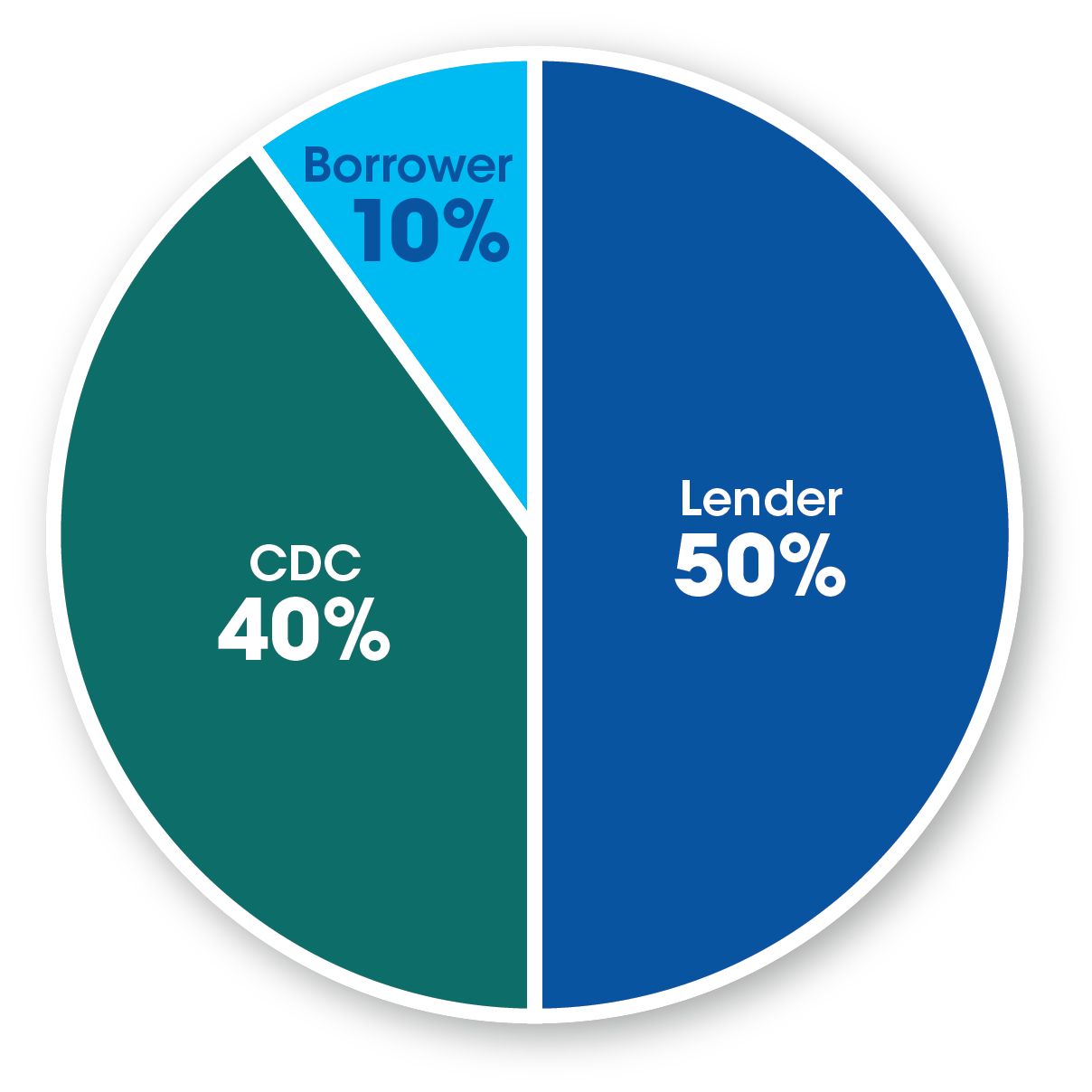

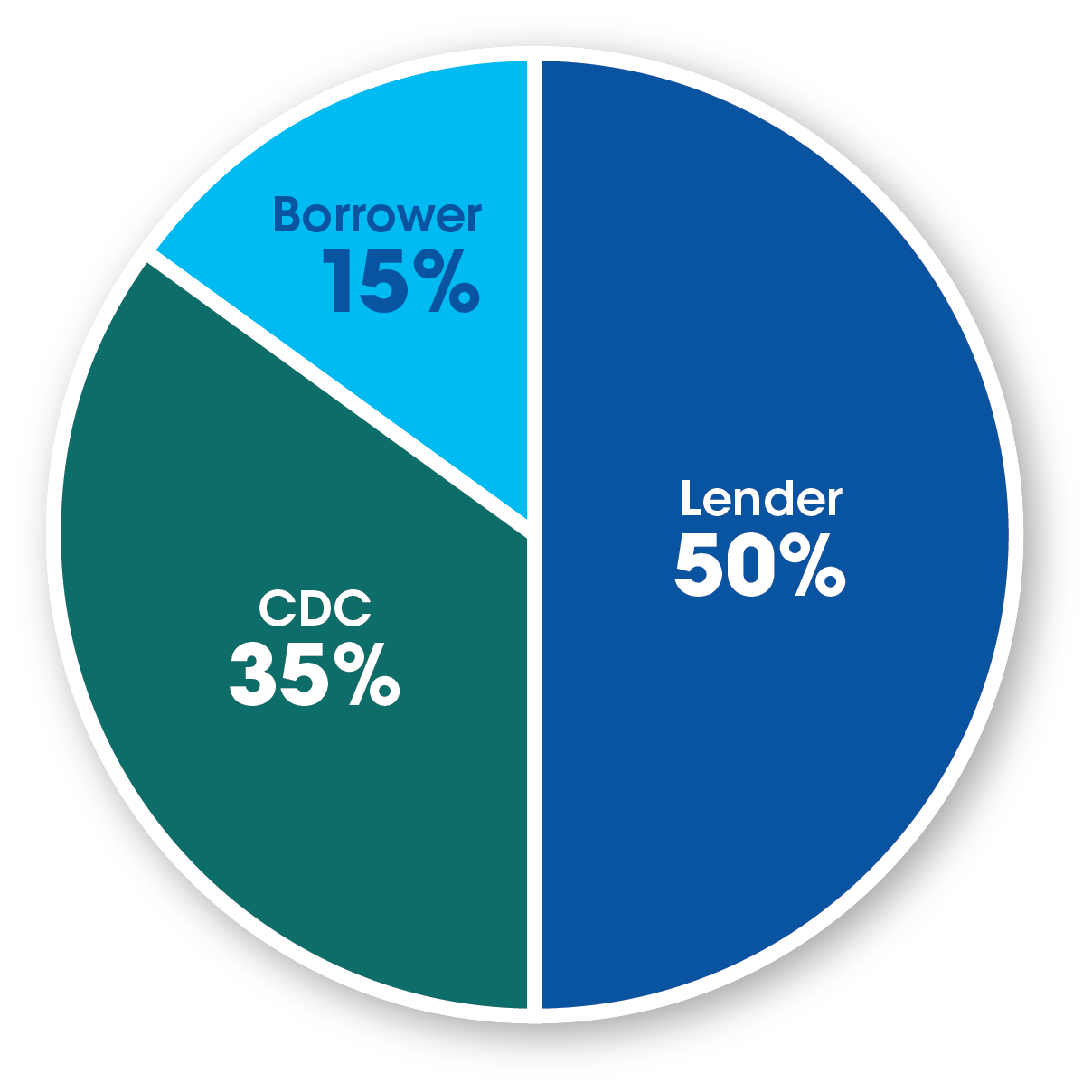

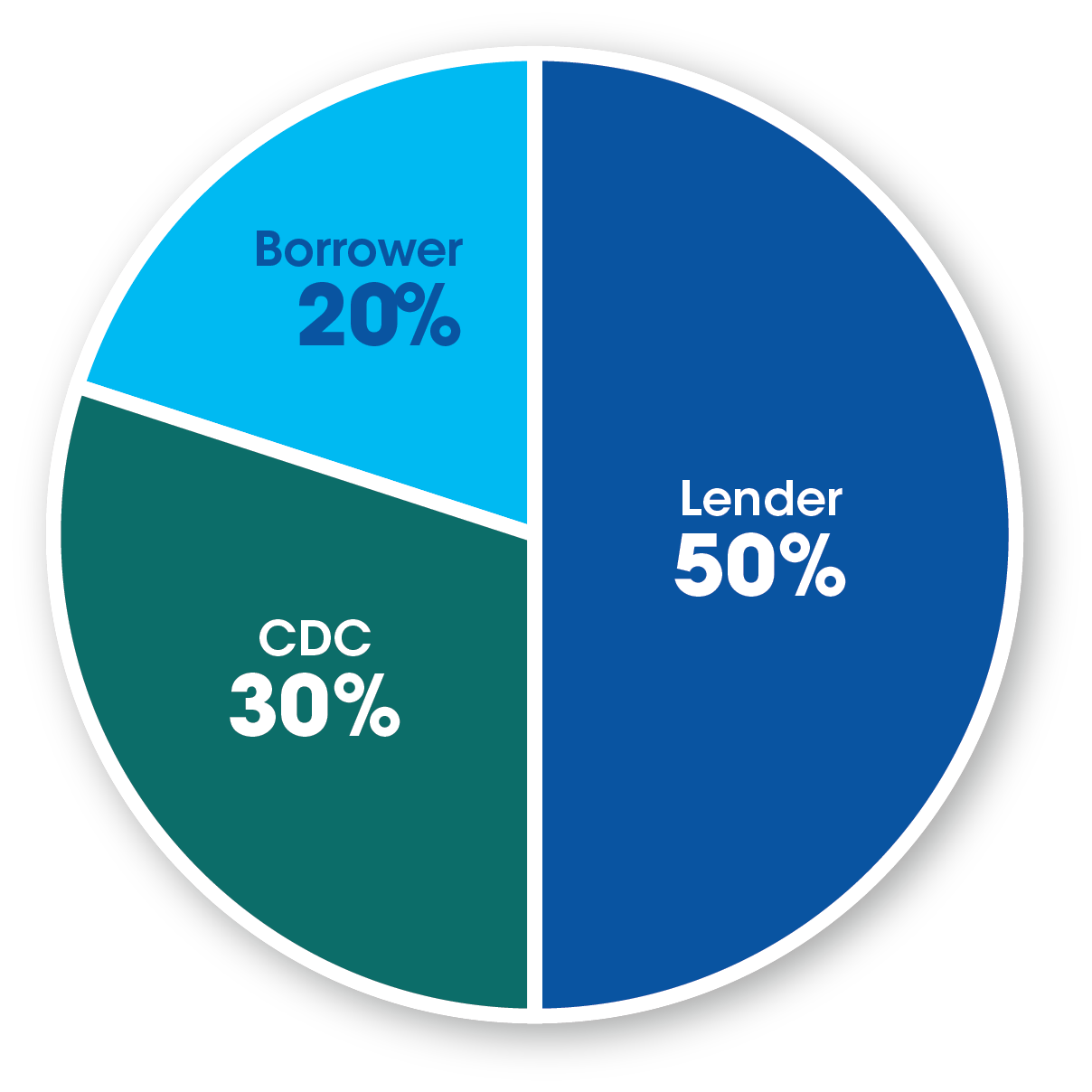

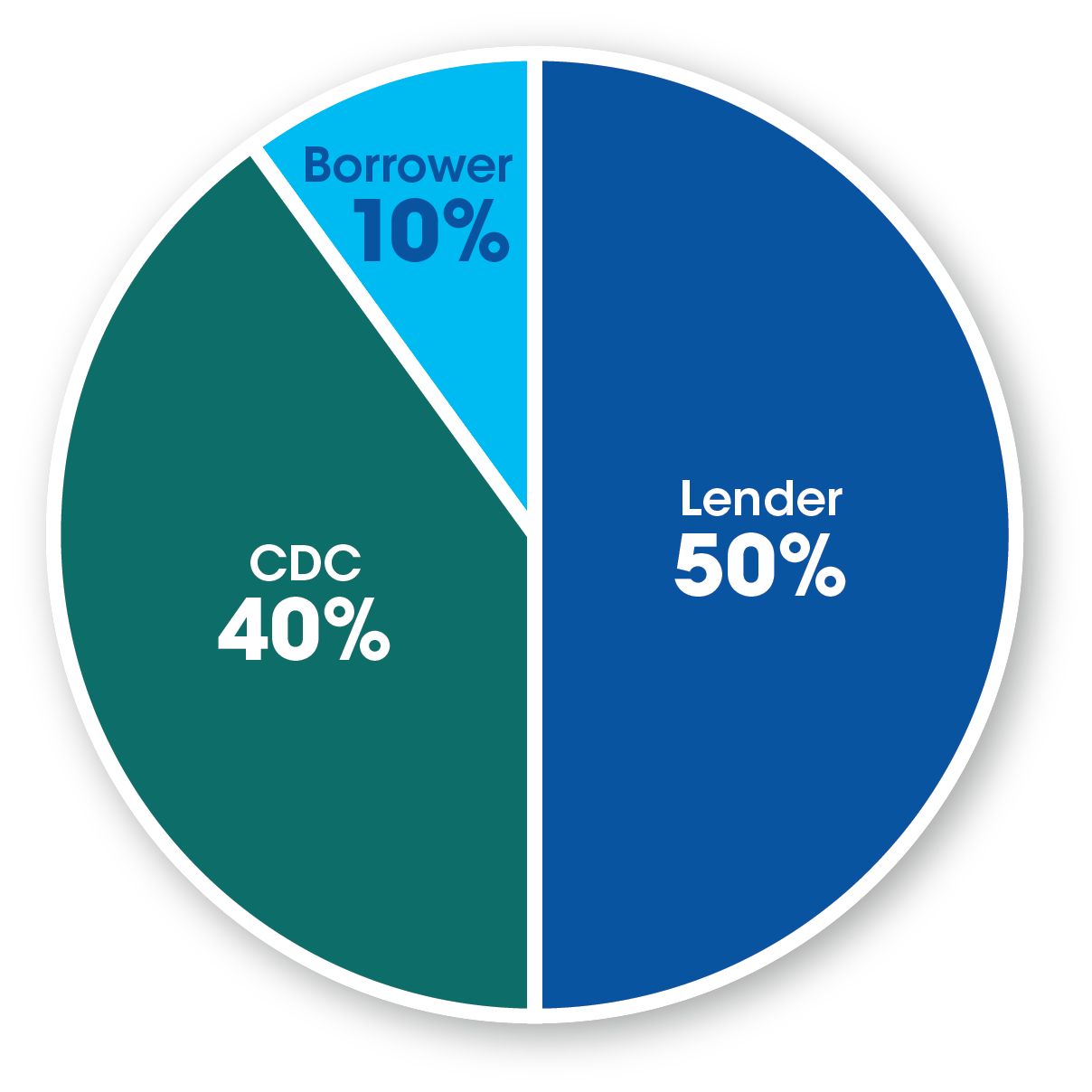

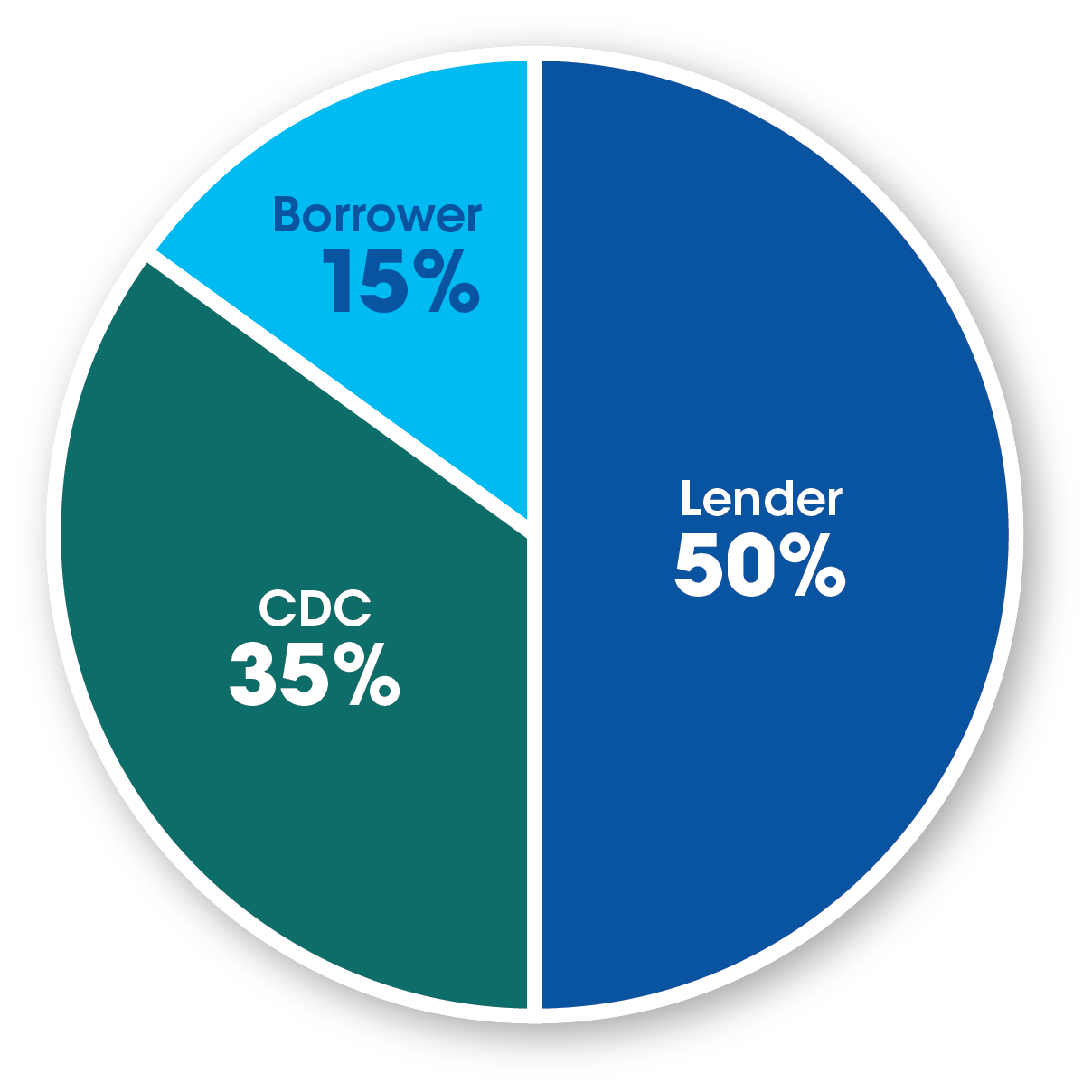

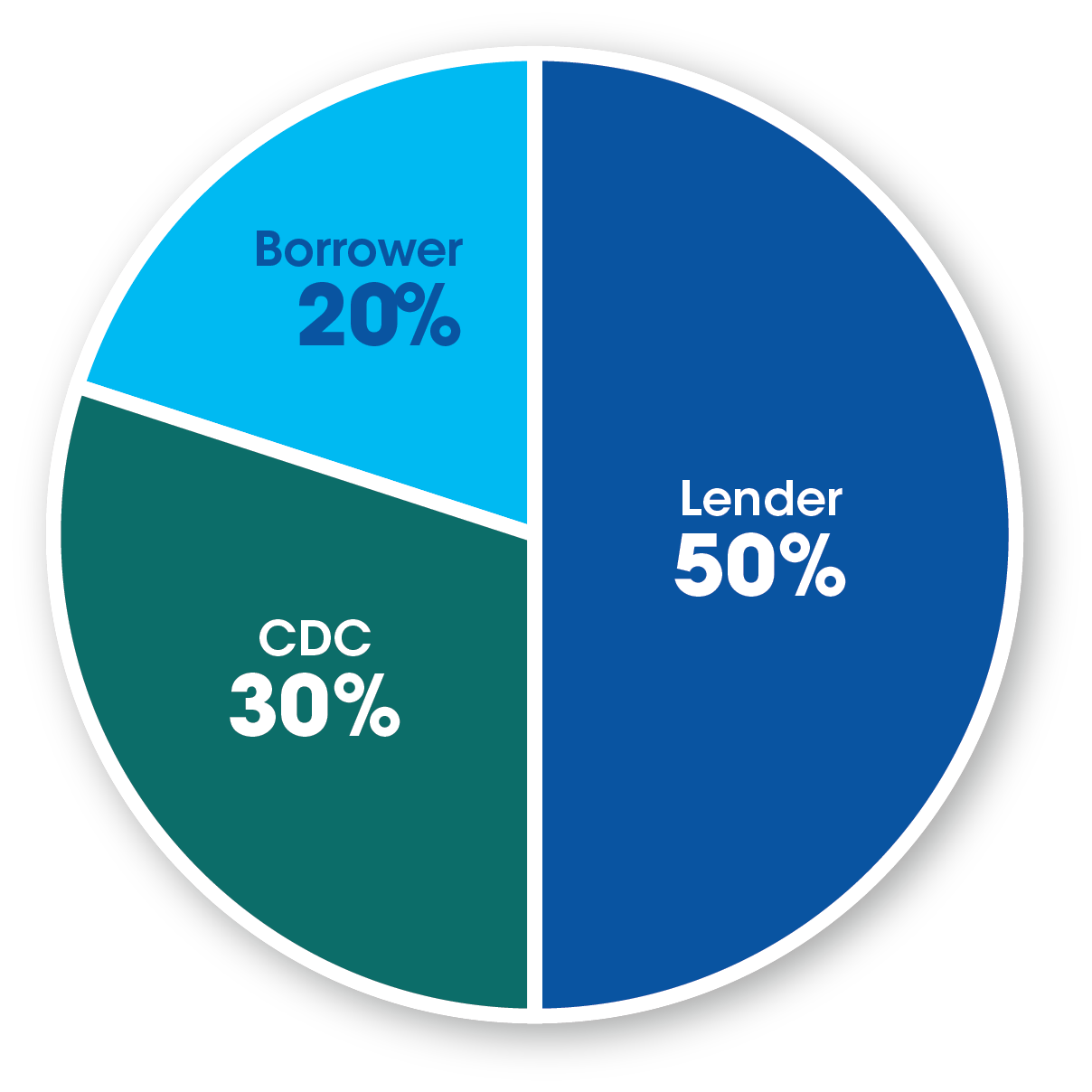

SBA 504 loans differ from other loan programs because of their three-part structure, which includes the lender, a Certified Development Company (CDC) and a borrower.

Varying circumstances affect the model breakdown and down payment responsibility of the borrower within that structure:

| Business Type |

Payment Responsibility |

| Typical business in operation for more than two years |

|

Start-up or new business in operation for less than two years

OR

Special-purpose property in business for more than two years |

|

| New business AND special purpose property |

|

Special Purpose Properties

A special purpose property is one that is not easily converted for other uses and where the operation of the business is tied directly to the real property value and physical location. Examples include car washes, museums, sports arenas, gas stations, hospitals and theatres.

Although the borrower’s contribution is higher in a special purpose property, SBA financing is often a better option than conventional terms, which often require upwards of 30% down from borrowers.

Loan Requirements

To be eligible for a 504 Loan, your business must:

- Operate as a for-profit company in the United States or its possessions

- Have a tangible net worth of less than $15 million

- Have an average net income of less than $5 million after federal income taxes for the two years preceding your application

There are other general eligibility standards for an SBA 504 loan including SBA size guidelines, qualified management expertise, and a feasible business plan. Loans cannot be made to businesses engaged in nonprofit, passive, or speculative activities.

The SBA 504 Debt Refinancing program is for business owners with an existing real estate loan. By refinancing long-term debt, or consolidating multiple loans, the program can help you save money with lower payments and a lower fixed interest rate.

Working with Stearns Bank, a Preferred SBA Lender, you can:

|

Lower your interest rate

Refinance at a rate below conventional long-term interest rates, saving significant money over the term of your loan |

|

Reduce monthly debt payments

Lower payments by extending loan terms up to 25 years, easing your debt burden and cash flow challenges |

|

Consolidate debt

Consolidate high-interest, adjustable-rate debt at a lower, fixed interest rate |

|

Obtain cash

Borrowers can obtain cash for up to 20% of appraised businesses assets to meet future operating expenses |

|

Release equity, reinvest in your business

Equity tied up in fixed assets can be turned into cash, which you can reinvest for growth and expansion |

|

Save on out-of-pocket expenses – Borrowers can finance ordinary closing costs, rolling them into their new loan |

Stearns Bank is experienced with SBA programs, including SBA 7(a) and SBA 504. You will meet personally with a lender, who will review your current business situation and plans, and develop creative financing options that fit you.

With quick turnaround time, often in a matter of hours, SBA Express loans are a great option to help increase your liquidity.

Everyday Expenses

SBA Express loans can help your business operate or expand when funds are not readily available. These fully amortizing loans have no prepayment penalties and are available to a range of businesses, excluding startups.

Borrowers may use SBA Express loans in a variety of ways, including:

- Purchasing equipment

- Hiring employees

- Purchasing inventory or advertising

- Refinancing existing debt

- Updating software

Loan Requirements

SBA Express loan requirements state that your business must:

- Be a for-profit business operating in the U.S.

- Be a small business, as defined by the SBA

- And, that as a business owner, you have invested your own time and money into the business

From weathering a slow season to exploring a new expansion opportunity, or to catch up on expenses, an SBA Express loan could be the link needed to cross into the next phase of business.

Used to help businesses enter and expand into international markets, the SBA’s International Trade Loan (ITL) offers a combination of fixed asset, working capital financing and debt refinancing.

Exporter Eligibility

To be eligible, your business must:

- Be a for-profit business operating in the U.S.

- Be a small business, as defined by the SBA

- Have, as a business owner, invested your own time and money into your business

- Establish that the loan will allow the business to expand or develop an export market, or enable the business to improve its competitive position

Foreign Buyer Eligibility

To be eligible to purchase goods or services from your business, foreign buyers must be in countries wherein the Export-Import Bank of the U.S. is not prohibited from providing financial assistance.

Use of Proceeds

For the facilities and equipment portion of the loan, proceeds may be used to acquire, construct, renovate, improve or expand these assets in the U.S. to produce goods or services involved in international trade.

- Working capital is an allowable use of proceeds under the ITL.

- Proceeds may be used for the refinancing of debt structured with unreasonable terms and conditions, including any debt that qualifies for refinancing under the standard SBA 7(a) Loan Program.