Frequently Asked Questions (FAQ)

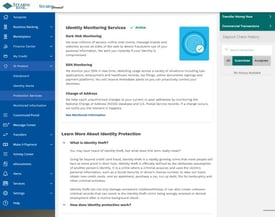

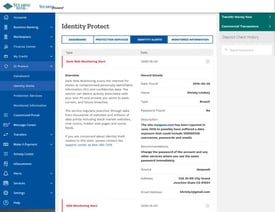

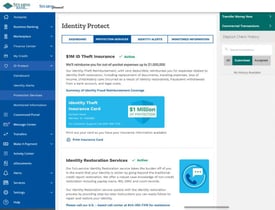

What is ID Protection used for?

ID Protection helps users keep their personal financial information safe from identity theft and fraud with dark web and SSN monitoring, alerts, and full-service restoration services.

How do users access ID Protection?

Users can easily access ID Protection within StearnsConnect by clicking the link to opt in and following the automated onboarding process.

Is ID Protection integrated into the Stearns Bank online and mobile account access?

Yes. ID Protection is available on StearnsConnect, our mobile application and online banking platform.

Who can benefit from ID Protection?

Nearly everyone! ID Protection helps users build and protect their financial futures.

Why is online identity protection important?

Identity theft and imposter scams are ranked among the top consumer complaints in the latest Federal Trade Commission's “Consumer Sentinel Network Data Book” (February 2021). The numbers are staggering:

- Identity theft skyrocketed in 2021, with the number of Q3 2021 data compromise victims (160 million) even higher than Q1 and Q2 combined (121 million).

- Government benefits theft rose an extraordinary 2,920% in 2020. In this subset of identity theft, victims said their personal information was used to apply for government benefits from unemployment to Social Security.

- Ransomware attacks increased 311% from 2019 to 2020 in the U.S., with a total payout of $350 million.