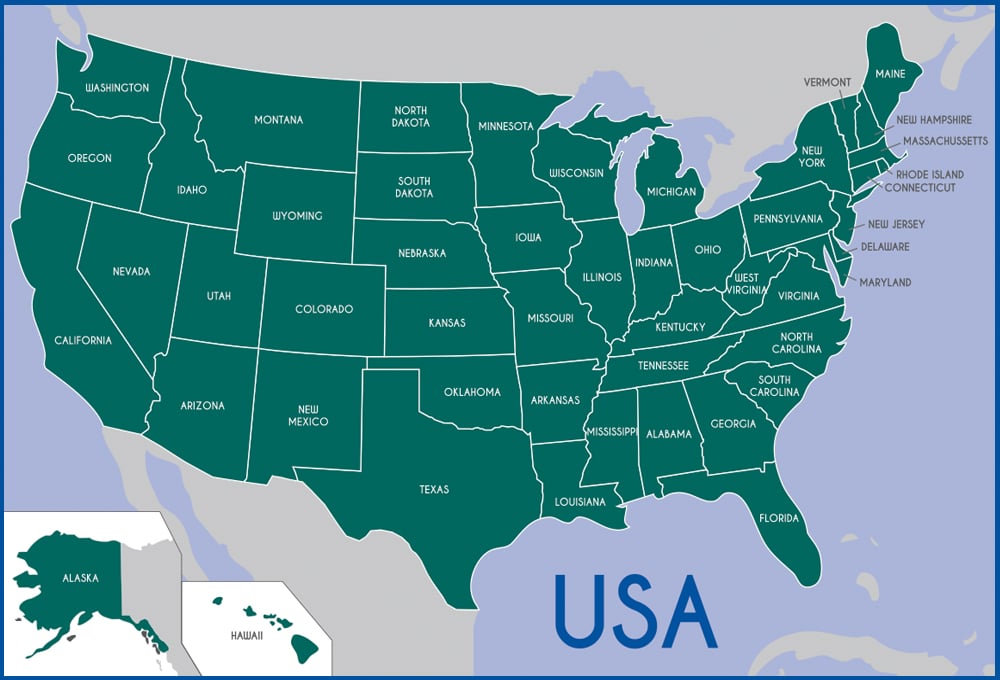

The USDA Business & Industry (B&I) Program is designed to grow, develop, improve, or finance businesses, industry and employment in specific rural areas. It is also designed to improve the economic and environmental conditions of rural areas.

Who may qualify for B&I loans?

- For-profit or non-profit businesses

- Cooperatives

- Federally-recognized Native American tribes

- Public bodies

- Individuals engaged in or proposing to engage in a business

Eligible uses include (but are not limited to):

- The purchase and development of land, buildings and associated infrastructure for commercial or industrial properties

- Business conversion, enlargement, repair, modernization or development

- The purchase and installation of machinery and equipment, supplies or inventory

- Debt refinancing, when it improves cash flow and creates jobs

- Acquisitions when the loan will maintain business operations and create or save jobs

Learn More

The Rural Energy for America Program (REAP) provides loan financing and grant funding to agricultural producers and rural small businesses in eligible locations for renewable energy systems or energy efficient enhancements. These changes are critical to increasing energy independence for the U.S. Over time, investments through the program can help lower the cost of energy for small businesses and agricultural producers.

Eligible uses include (but are not limited to):

- The purchase, installation and construction of energy efficiency improvements

- Biomass, such as biodiesel and ethanol, anaerobic digesters, and solid fuels

- Geothermal for electric generation or direct use

- Hydropower below 30 megawatts

- Hydrogen

- Wind generation

- Solar generation

- Ocean (tidal, current, thermal) generation

Key advantages include:

- Flexibility to secure larger loans amounts

- Longer terms

Learn More

The Biorefinery, Renewable Chemical, and Biobased Product Manufacturing Assistance Program (Section 9003), also know as BAP, provides loans to assist in the development, construction and retrofitting of new and emerging technologies in eligible areas.

Eligible uses include:

- Commercial-scale biorefineries using eligible technology, including advanced biofuels and renewable chemicals

- Biobased product manufacturing facilities that use technologically new commercial-scale processing and manufacturing equipment to convert renewable chemicals and other biobased outputs of biorefineries into end-user products on a commercial scale

- Refinancing, in certain circumstances

The limited-time USDA Food Supply Chain Guaranteed Loan Program was implemented in September 2021 to strengthen America's food supply chain. This program differs from most USDA programs in that it does not include geographical restrictions within the U.S.

Key advantages include:

- No guarantee or renewal fees

- Competitive interest rates

- Longer repayment terms

- Full amortization

- Higher loan amount options

Eligible uses, for food supply chain participants, include (but are not limited to):

- The purchase and development of land, buildings or infrastructure

- Machinery or equipment

- Startup costs

- Working capital

- Inventory and supplies

Learn More

The Water & Waste Disposal loan and grant program provides funding for clean and reliable drinking water systems, sanitary sewage disposal, sanitary solid waste disposal, and storm water drainage in eligible areas.

Eligible uses include (but are not limited to):

- Drinking water sourcing, treatment, storage and distribution

- Sewer collection, transmission, treatment and disposal

- Solid waste collection, disposal and closure

- Storm water collection, transmission and disposal

A range of Community Facilities Programs exist to develop or improve essential public services and facility in rural communities across the U.S. Such development helps retain businesses that provide employment and services to residents.

Eligible uses include (but are not limited to):

- Fire and rescue stations

- Village and town halls

- Health care clinics

- Hospitals

- Adult and child care centers

- Assisted living facilities

- Rehab centers

- Public buildings

- Schools

- Libraries

- Land acquisition

- Professional fees

- Purchase of equipment